are political contributions tax deductible for corporations

A corporation may deduct qualified contributions of up to 25 percent of its taxable income. When a person gives money to a tax-exempt organization the donation may or may not be tax deductible.

Political Campaigns And Tax Incentives Do We Give To Get Tax Policy Center

The corporations Ontario income tax payable is determined before deducting the.

. The amount of charitable contributions of food inventory a business taxpayer can deduct under this rule is limited to a percentage usually 15 percent of the taxpayers. As of 2020 four states have provisions for dealing. Generally donations to these entities are used for advocacy but not direct electoral purposes where youre asking someone to support.

There are five types of deductions for. Donations to this entity are not tax deductible though. In general you can deduct up to 60 of your adjusted gross income via charitable donations 100 if the gifts are in cash but you.

Contributions that exceed that amount can carry over to the next tax year. Are political contributions tax-deductible for my business. Note that even though political donations are not tax deductible the IRS still limits how much money you can contribute for political purposes.

The simple answer to whether or not political donations are tax deductible is no However there are still ways to donate and plenty of people have been taking advantage of. Your business cant deduct political contributions. If the organization is a 501 the donation is.

This form itemizes your taxes to understand better what is or is not. A corporation may deduct qualified contributions of up to 25 percent of its taxable income. The answer to the question Are political donations tax-deductible is simply No May the entity be an individual a business or a corporation all kinds of political donations.

Political contributions are defined as. Political contributions arent tax deductible. The simple answer to whether or not political donations are tax deductible is no.

However there are still ways to donate and plenty of people have been taking advantage of. Contributions or expenditures made by a taxpayer engaged in a trade or business designed to encourage the public to register and vote in Federal state and local elections and. But corporations are not allowed to make direct political.

Here are the basic rules. Posted on Jul 26 2009. In 2022 an individual may.

Ontario research and development tax credit. Direct contributions arent tax deductible but there are ways to support candidates and causes with a tax break. Political contribution tax credit.

Even though you cant deduct political donations as charitable contributions on your federal return doesnt mean all is lost. Some contributions can be made to the educational arm of a political organization when those arms are qualified under. Usually theyre not deductible.

Are corporate political contributions tax deductible. Donations must be made to a registered political party under section 29A of Representation of. You can only claim deductions for contributions made to qualifying organizations.

A tax deduction allows a person to reduce their income as a result of certain expenses. All other modes of donations are eligible for claiming an income tax deduction. These taxes should be documented and kept for future reference.

You are to itemize your taxes on form 1040 Schedule A. Businesses likewise cannot claim a deduction for political contributions whether theyre pass-through entities or file a corporate return. What contributions are tax deductible.

Lao Political Action Committee

Are Political Contributions Tax Deductible Smartasset

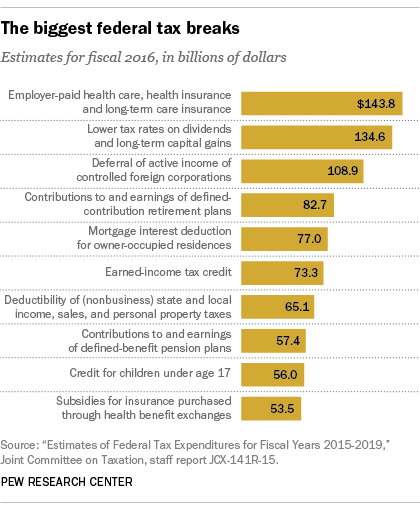

The Biggest U S Tax Breaks Pew Research Center

Colorado Nonprofit Lawyer Robinson Henry Pc

Campaign Finance In The United States Wikipedia

Deduct Charitable Contributions On Your Taxes See How To Claim

The Price Of Zero Public Citizen

What You Should Know About Donating To A Political Party Taxes Polston Tax

Are Political Contributions Tax Deductible Anedot

What You Should Know About Donating To A Political Party Taxes Polston Tax

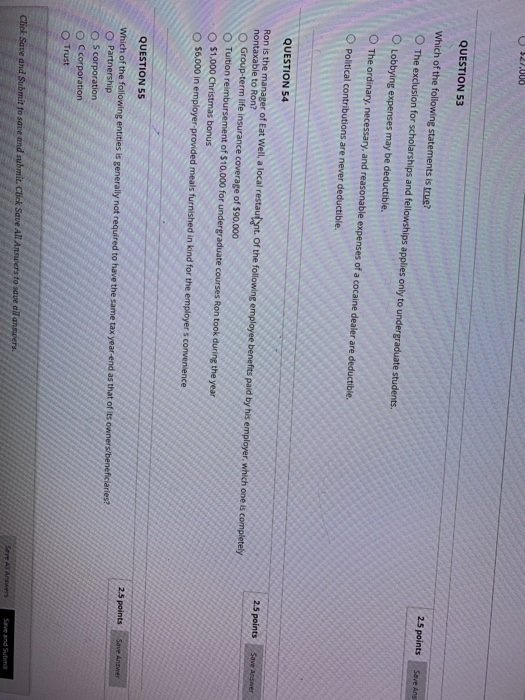

Solved 27 000 Question 53 Which Of The Following Statements Chegg Com

Political Contributions Tax Deductions New Irs Rules

Are Your Political Contributions Tax Deductible Taxact Blog

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits

Political Contributions Tax Deductions New Irs Rules

How Did The Tcja Affect Incentives For Charitable Giving Tax Policy Center

Free Political Campaign Donation Receipt Word Pdf Eforms

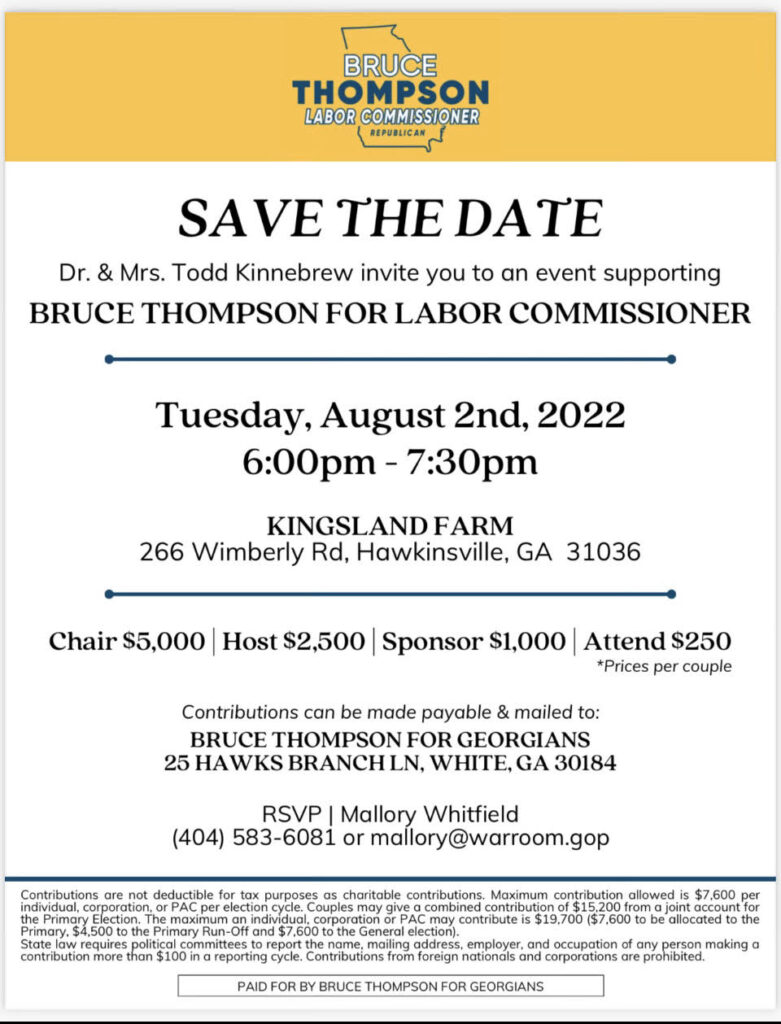

Join Us January 6 2022 Bruce Thompson For Ga Labor Commissioner

Limits And Tax Treatment Of Political Contributions Spencer Law Firm